#1 Housing Supply

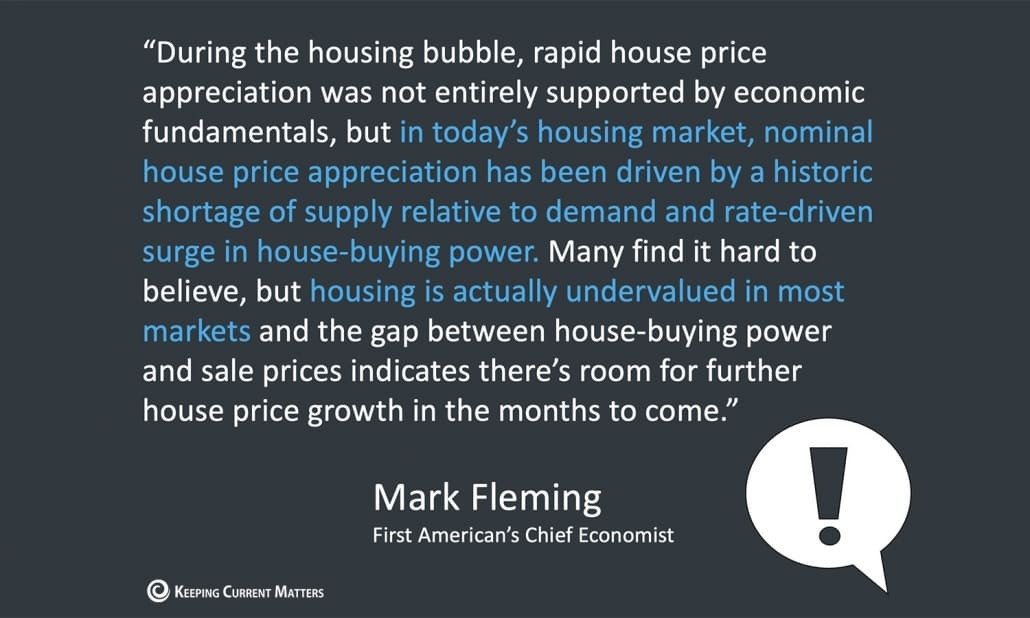

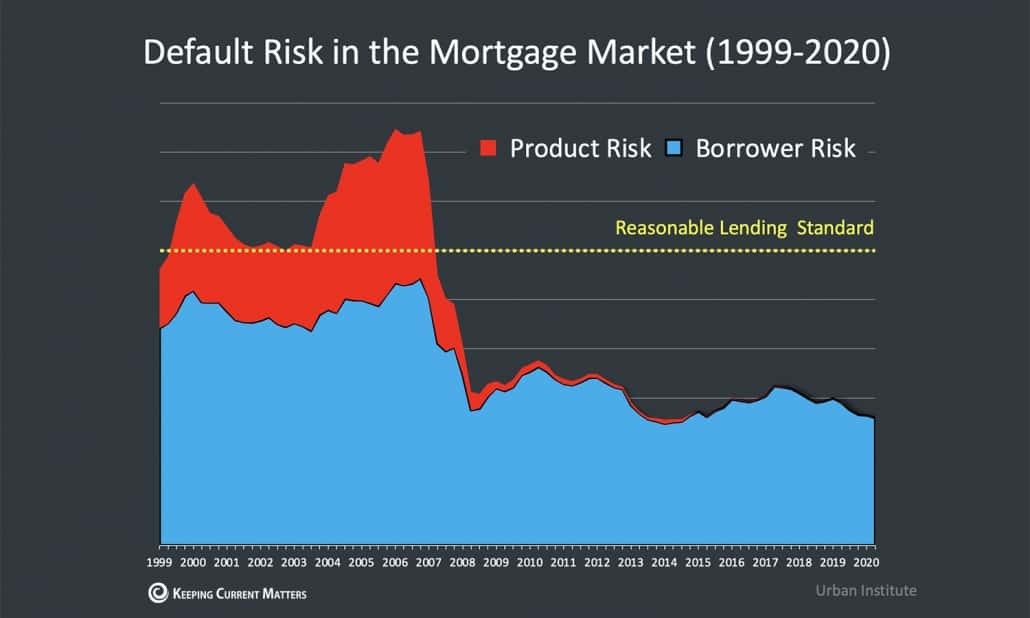

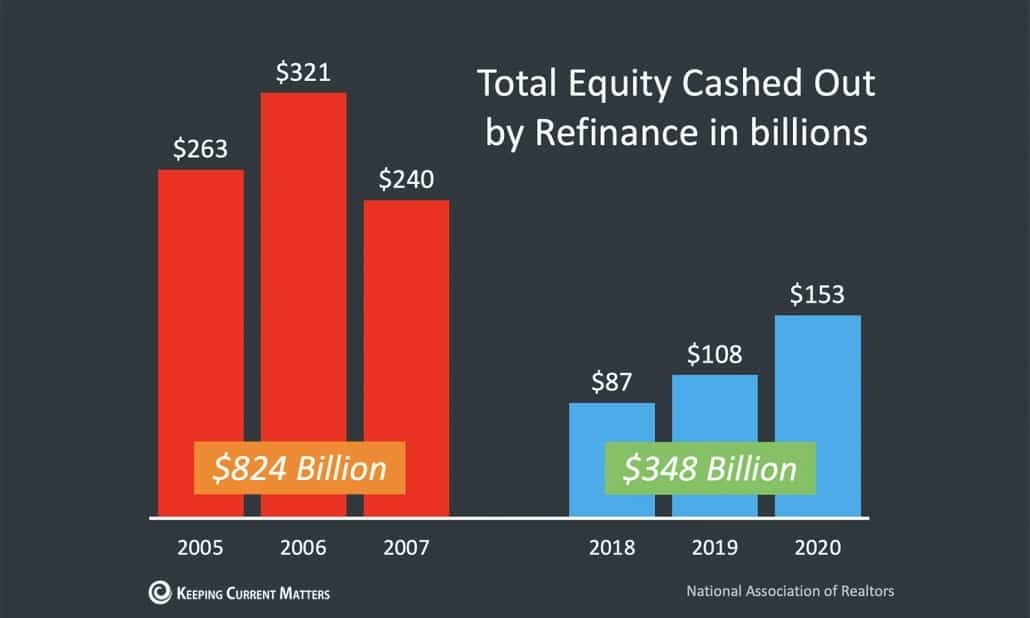

This past year, home prices have appreciated rapidly causing worry for buyers and sellers that home prices are too high and that depreciation is likely to follow.

Unlike the Housing Bubble years of the mid-2000s, the major factor driving up home values is that we are also in a dire inventory shortage. In 2008, we had 13 1/2 months of inventory, today we have less than a month's worth, a historically low amount.

Throwing it back to your high school economics class, the biggest driver of price appreciation is a simple case of supply and demand, hence what we’re seeing in the market today

.png)

.png)

.png)

.png)