Forecasting Home Prices for 2020

Forecasting home prices 🔮 has become extremely difficult.

I’ll explain …

A worldwide pandemic and an economic recession have had a tremendous effect on the nation.

The uncertainty brought about by both has made predicting consumer behavior nearly impossible.

For that reason, forecasting home prices has become extremely difficult.

For those of you who are new to my email VLOGs, I am Keith with the Walker Team of Intero and welcome to another weekly update in housing!

I post new videos every week covering current topics in the housing market both at a national level and at a local level to keep those close to me informed and educated around the topic of real estate.

TODAY'S TOPIC

Normally, there’s a simple formula to determine the future price of any item:

Calculate the supply of that item in ratio to the demand for that item. In housing right now, demand far exceeds supply.

Mortgage applications to buy a home just rose to the highest level in 11 years while inventory of homes for sale is at (or near) an all-time low. That would usually indicate strong appreciation for home values as we move throughout the year.

Some experts, however, are not convinced the current rush of purchasers is sustainable. Ralph McLaughlin, Chief Economist at Haus, explained in their June 2020 Housing Market Forecast why there is a concern:

"The upswing that we’ll see this summer is a result of pent-up demand from homebuyers and supply-in-progress from homebuilders that has simply been pushed off a few months. However, after this pent-up demand goes away, the true economic scarring due to the pandemic will begin to affect the housing market as the tide of pent-up demand goes out."

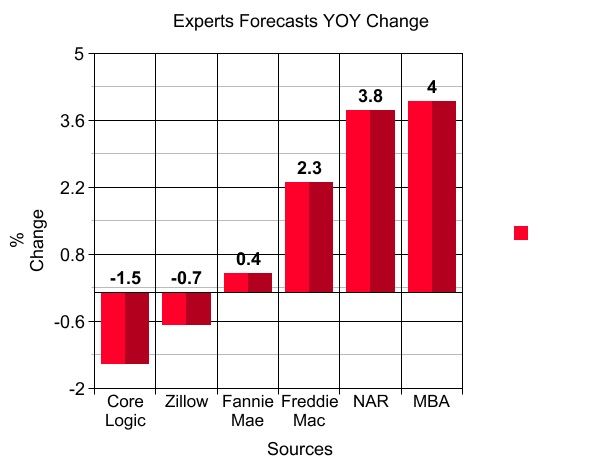

The virus and other challenges currently impacting the industry have created a wide range of thoughts regarding the future of home prices. Here’s a list of analysts and their projections, from the lowest depreciation to the highest appreciation:

We can garner two important points from this list:

- There is no real consensus among the experts.

- No one projects prices to crash as they did in 2008.

At a local level, the housing supply levels are even lower than the national averages while buyer demand is remaining strong. Today in the Santa Clara County there are under 1600 homes for sale while around 1400 are pending or contingent.

That’s less than 2 months of housing supply.

With so many buyers for such a limited number of available homes, we are seeing multiple offers on properties in every city in the county.

By comparison, in 2008, we had 13 1/2 months of housing supply.

The Bottom Line

Whether you’re thinking of buying a home or selling your house, know that home prices will not change dramatically this year, even with all of the uncertainty we’ve faced in 2020.

If you are thinking of buying or selling in Silicon Valley, reach out to me today so I can guide you toward reaching your goals in real estate.

On the Walker Team, we have a wide range of experts who speak several languages to help you navigate the process with confidence!

Always remember, I am here to educate and navigate, not speculate, and fabricate.

.png)

.png)

.png)

.png)

.png?w=128&h=128)